Rio vs Miami vs Dubai 2026: Where Millionaires Should Still Buy a Second Home

Rio de Janeiro, Miami or Dubai in 2026 – where should ultra-high-net-worth individuals still park their money in a second (or third) luxury residence?

We compared the three hottest luxury real estate markets for millionaires: current price per m², expected capital growth until 2030, gross rental yields, taxation, residency programs and real lifestyle quality.

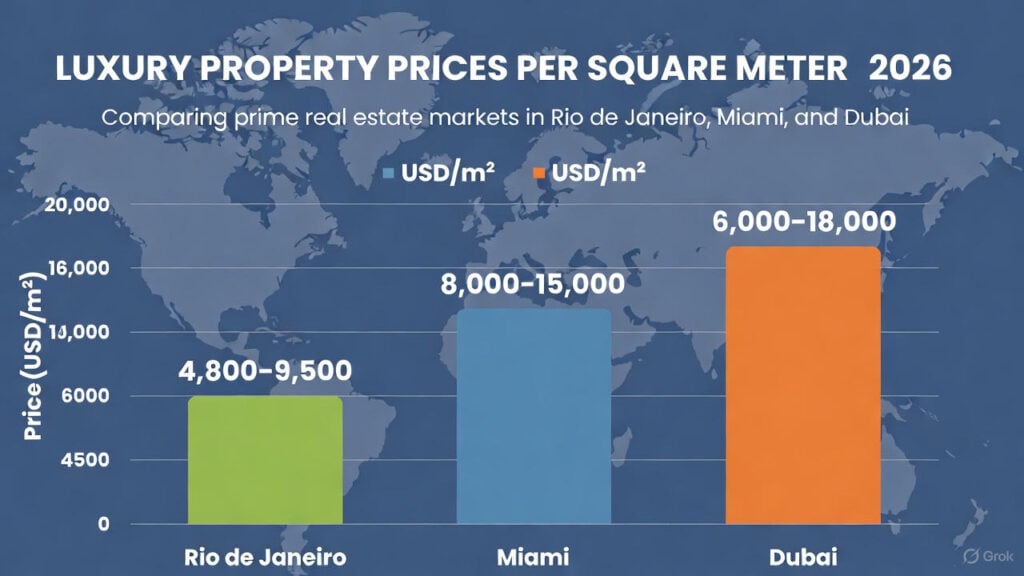

1. Luxury Property Prices 2026 – Who is still “affordable”?

Average price per square meter in the absolute prime locations (Q4 2025 estimates):

- Dubai (Palm Jumeirah, Downtown, Emirates Hills): $9,500 – $18,000 USD/m²

- Miami (Fisher Island, Star Island, Faena House): $8,000 – $15,000 USD/m²

- Rio de Janeiro (Leblon oceanfront, Urca, Lagoa penthouses): $4,800 – $9,500 USD/m²

Winner 2026: Rio de Janeiro – you still get ocean-view penthouses and villas under $9,000/m² that would easily cost double in Miami or Dubai.

2. Capital Growth Forecast 2026–2030

- Dubai: +25–35 % (driven by Expo legacy & crypto money)

- Miami: +20–30 % (continued influx from New York & Latin America)

- Rio de Janeiro: +40–65 % (Golden Visa boom + infrastructure in Barra Olímpica & Porto Maravilha)

Winner: Rio – highest projected appreciation among the three.

3. Gross Rental Yields (Prime Locations)

- Dubai: 5–7 % (short-term holiday lets dominate)

- Miami: 4–6 % (strong seasonal demand)

- Rio de Janeiro: 6–9 % (Carnival, New Year, growing corporate long-term)

Winner: Rio again – especially with professional management.

4. Taxation & Ownership Costs

- Dubai: 0 % income tax, 0 % capital gains, 4 % transfer fee

- Miami: Florida property tax ~1.1 %, US worldwide taxation for citizens

- Rio/Brazil: 0 % capital gains for individuals on primary residence, 4–6 % transfer tax, low annual IPTU (~0.4–0.8 %)

5. Residency & Golden Visa Routes 2026

- Dubai – 10-year Golden Visa from ~$540 k property

- Miami – no direct residency through real estate (EB-5 from $800 k)

- Brazil – Golden Visa expected €500 k–€700 k real estate route again in 2026/27 (currently suspended, reopening highly likely)

6. Lifestyle & Exclusivity

All three cities are spectacular – but in different ways:

- Dubai = tax-free, ultra-modern, 24/7 luxury

- Miami = American infrastructure, boating, art scene

- Rio = nature (ocean + mountain), culture, Carnival, authentic carioca lifestyle

Conclusion: The 2026 Winner for Millionaires

If you already own in Dubai or Miami and are looking for the next undervalued luxury market with the highest upside – Rio de Janeiro is the clear winner in 2026/27.

Lowest entry price + highest projected growth + strong rental yields + upcoming Golden Visa route + unbeatable natural beauty.

Ready to secure your piece of Rio before the next wave?

Contact our private client team for off-market penthouses and villas in Leblon, Ipanema, Urca and the new Barra Olímpica developments.Request Off-Market List →

Frequently Asked Questions

Is Rio de Janeiro safe for luxury real estate investment in 2026?

Prime neighborhoods (Leblon, Ipanema, Urca, Lagoa) have 24/7 private security and belong to the safest areas in South America.

Will Brazil reopen the Golden Visa via real estate in 2026?

Multiple sources and government signals point to a relaunch with a €500 k–€700 k real estate investment route in 2026/27.

Last updated: December 2025 – All figures are estimates based on current market data.